A Regeneron executive and one of its directors sold $1 million worth of stocks two days after President Donald Trump announced he was taking their therapeutic, recent filings from the Securities and Exchange Commission reveal.

Last Friday night, the White House announced that as part of Trump’s treatment for coronavirus, he had received Regeneron’s experimental antibody cocktail that has not passed formal trials or been approved by the Food and Drug Administration.

One day later, the president appeared in a video posted to his Twitter account about his treatment at Walter Reed National Military Medical Center.

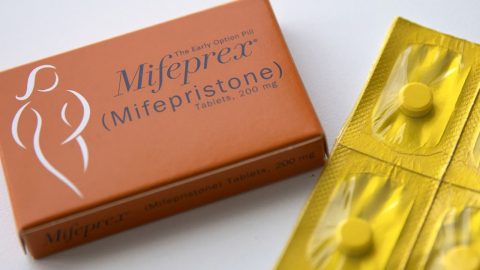

“They gave me Regeneron,” he said, saying the company name instead of the treatment’s name, REGN-COV2. “It was like, unbelievable. I felt good immediately. I felt as good three days ago as I do now.”

At another point in the video he said that the therapeutics he was given were “miracles…we have things happening that look like they’re miracles coming down from God.”

“I think this was a blessing from God that I caught [the virus], I think it was a blessing in disguise,” Trump said in the video. “I caught it, I heard about this drug, I said, ‘Let me take it’ … and it was incredible the way it worked.”

“I call that a cure,” he said. “It’s a cure.”

After the video posted, Regeneron’s stock jumped over 3 percent in after-hours trading.

On Monday, when markets opened, Regeneron stock prices surged from $564 to over $600 a share. That day, Joseph Goldstein, who sits on the company’s board of directors, and SVP and Head of Commercial Marion McCourt exercised stock options that let them sell a total of 10,200 shares for a net profit of over $1 million. According to filings, that netted about $740,000 for Goldstein and $260,000 for McCourt.

Company executives have been selling shares at the company on a regular basis, but insider sales activity jumped at the same time the coronavirus took hold in the United States, starting the second quarter of 2020, according to data collected by MarketBeat. The year isn’t over and already $100 million more in stock has been sold compared to 2019 and 2018 — $248 million vs $142 million and $143 million, respectively — a 70 percent increase. The company’s stock price has climbed from $400 to $600 a share from the beginning of the year, a 50 percent increase.

The SEC did not immediately respond to a request for comment Friday evening.

The New York Times reported that Trump’s financial documents reveal the president’s three family trusts held investments in Regeneron as well as pharmaceutical giant Sanofi, which itself is a major shareholder in Regeneron. His 2017 filing with the U.S. Office of Government Ethics disclosed shares in Regeneron, but they did not appear on his 2020 filing.

A Regeneron company spokesperson said Goldstein and McCourt’s stock sales were pre-planned through a mechanism designed to avoid accusations of insider trading and were automatically triggered by the stock hitting certain levels.

“Those [Oct. 5] transactions were conducted pursuant to 10b5-1 plans,” Regeneron spokesperson Alexandra Bowie told NBC News in an email. “These are pre-established at a time when the executive/director is not aware of any material, nonpublic information about Regeneron and automatically trigger when the stock hits a certain price.”

After NBC News asked for copies of the plans, Bowie said, “The plans themselves are not public.” When asked for the dates the plans were first created and modified, Bowie said the company “practice” was “to require at least a 30 day ‘waiting period’ before a plan becomes effective.”

Accountable Pharma, a campaign of the watchdog group Accountable.US, said the sales raised potential ethical concerns for the Trump administration and the drug company executives and called for an “investigation.”

“This is the latest case in a clear pattern of President Trump pumping up stocks with his ‘miracle cure’ hype and pledges of taxpayer dollars while drug company executives dump their shares and guarantee they come out ahead whether their treatment works or not,” spokesman Eli Zupnick said in an email.

“There should absolutely be an investigation to determine whether there were any improprieties regarding these stock sales, including any potential government action taken to enrich President Trump or his political advisers,” he wrote.

Daniel Taylor, associate professor of accounting at The Wharton School at the University of Pennsylvania, said that the steps the companies executives took to set up a pre-determined sale schedule should protect them from any legal action.

“If 10b5-1 are put in place well in advance of any event, it provides safe harbor regardless of the event,” he said.

But companies and executives need to avoid even the appearance of impropriety and be mindful of how the appearance of well-timed trades can create reputational risks, he said.

“They company doesn’t want people to think their executives are trading opportunistically,” Taylor said.

The SEC didn’t immediately respond to a request for comment sent Friday evening.

Recent Comments